Have you ever looked at your credit score and wondered, “What exactly is driving this number?” If so, you’re not alone. While many are familiar with FICO scores, VantageScore 3.0 often takes a back seat in the credit conversation. But here’s the thing: this scoring model plays a significant role in how lenders assess your creditworthiness.

VantageScore 3.0 isn’t just another score—it’s a modern take on evaluating credit that aims to be fairer and more accessible. So, whether you’re building credit, trying to understand your finances better, or curious about what’s behind the scenes, this guide is here to help. Let’s break down what makes VantageScore 3.0 unique, how it works, and why it’s worth understanding.

What Is VantageScore 3.0?

VantageScore 3.0 is a credit scoring model developed by the three major credit bureaus—Equifax, Experian, and TransUnion. Launched in 2013, it was designed to provide a more consistent and inclusive way of assessing creditworthiness.

Unlike older models, VantageScore 3.0 aims to:

- Include consumers with limited credit histories.

- Simplify the scoring process for lenders.

- Provide a more predictive score for today’s financial behaviors.

It’s worth noting that while FICO scores are still widely used, VantageScore is gaining traction, especially among lenders looking for alternative ways to evaluate borrowers.

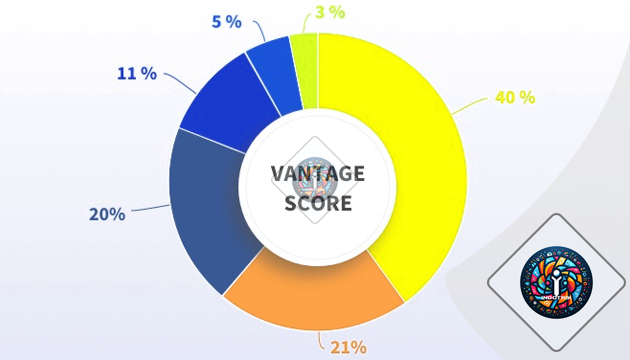

How Is VantageScore 3.0 Calculated?

Understanding the components of VantageScore 3.0 is key to knowing what influences your score. Here’s a breakdown of the factors and their weightings:

1. Payment History (40%)

This is the most significant factor, emphasizing the importance of paying your bills on time. Even one missed payment can have a noticeable impact.

2. Credit Utilization (20%)

This measures how much of your available credit you’re using. Keeping your usage low—ideally below 30%—can boost your score.

3. Credit Age and Mix (21%)

The age of your credit accounts and the variety of credit types (e.g., credit cards, loans) both contribute to this factor. A longer history and diverse credit mix are seen as positives.

4. Total Balances (11%)

Your total debt across all accounts is another factor. Lower balances relative to your credit limits are better for your score.

5. Recent Credit Behavior (5%)

This looks at how often you apply for credit. Too many inquiries in a short period can be a red flag to lenders.

6. Available Credit (3%)

The amount of credit available to you, even if unused, helps show lenders that you have financial flexibility.

What Makes VantageScore 3.0 Different?

1. Inclusion of Thin Credit Profiles

VantageScore 3.0 is more inclusive, scoring consumers with as little as one month of credit history. This makes it ideal for those just starting their credit journey.

2. No Penalization for Collections Paid in Full

Unlike some scoring models, VantageScore 3.0 doesn’t penalize you for collection accounts that have been fully paid off. This is a game-changer for anyone working to repair their credit.

3. Use of Trended Data

The model considers trends in your credit behavior, such as whether your balances are increasing or decreasing over time. This provides a more dynamic view of your financial habits.

4. Less Impact from Medical Collections

Medical debt has a reduced impact on VantageScore 3.0 compared to other models, recognizing the unique nature of healthcare expenses.

How Does VantageScore 3.0 Compare to FICO?

Both models assess creditworthiness, but they have key differences:

| Feature | VantageScore 3.0 | FICO Score |

|---|---|---|

| Minimum Credit History | 1 month | 6 months |

| Trended Data | Yes | No |

| Impact of Paid Collections | Excluded | May still affect score |

| Medical Debt Weight | Lower | Standard |

| Popularity with Lenders | Growing | Widely Used |

Why Should You Care About VantageScore 3.0?

Even if your bank or lender primarily uses FICO, understanding VantageScore 3.0 can still benefit you. Many credit monitoring services now provide this score, giving you insights into your financial health.

Additionally, lenders who use VantageScore tend to focus on inclusivity and modern financial behaviors, which can work in your favor if you have a limited credit history or are actively rebuilding your credit.

Tips to Improve Your VantageScore 3.0

If you’re looking to boost your score, here are actionable steps to take:

1. Pay Bills on Time

This can’t be overstated—it’s the most critical factor for your score.

2. Keep Credit Card Balances Low

Aim for a credit utilization rate below 30%, and even better, closer to 10%.

3. Check Your Credit Report for Errors

Mistakes happen, and disputing errors can quickly improve your score.

4. Limit Hard Inquiries

Apply for credit sparingly to avoid a drop in your score from too many hard pulls.

5. Diversify Your Credit

Adding different types of credit accounts, like a small personal loan, can positively influence your score.

6. Avoid Closing Old Accounts

Older accounts contribute to your credit age, so keep them open if possible.

Personal Take: Why VantageScore 3.0 Matters to Me

When I first started monitoring my credit, I focused only on my FICO score. But after learning about VantageScore 3.0, I realized it offered a clearer picture of my financial habits. For instance, its consideration of trends helped me see how my decreasing balances were boosting my score, something FICO didn’t highlight.

One unexpected win? After paying off an old collection, my VantageScore jumped significantly, whereas my FICO score barely moved. It made me appreciate how different scoring models cater to unique financial situations.

Final Thoughts: A Fresh Perspective on Credit

VantageScore 3.0 isn’t just another number—it’s a reflection of modern credit habits and inclusivity. Whether you’re just starting to build credit or looking to improve, understanding this model can give you an edge.

Remember, credit scores are tools, not judgments. They help lenders assess risk, but they also give you a roadmap to financial wellness. So, embrace the insights, take action, and watch your financial opportunities grow.