Imagine walking into a room and every lender smiles at you. That’s the magic of a 770 credit score! It’s not just a number—it’s a badge of financial responsibility, and it puts you in an elite category. Whether you’re buying a home, leasing a car, or applying for a credit card, a score like this can make life a whole lot easier (and cheaper).

So, what makes a 770 credit score so special? And how can you use it to your advantage while keeping it strong? Let’s unravel the story behind this stellar score and explore why it’s one of your most valuable financial assets.

What Does a 770 Credit Score Mean?

1. Near-Perfect Territory

A credit score of 770 lands in the “Very Good” range for most scoring models, like FICO and VantageScore. While it’s shy of the coveted “Excellent” category (800+), it’s close enough to enjoy almost all the same benefits.

2. A Symbol of Trust

Lenders love seeing a score like this because it tells them you’re a low-risk borrower. You’ve proven your ability to manage credit responsibly, which opens doors to better interest rates, exclusive rewards, and top-tier financial opportunities.

How a 770 Credit Score Compares

1. FICO and VantageScore Rankings

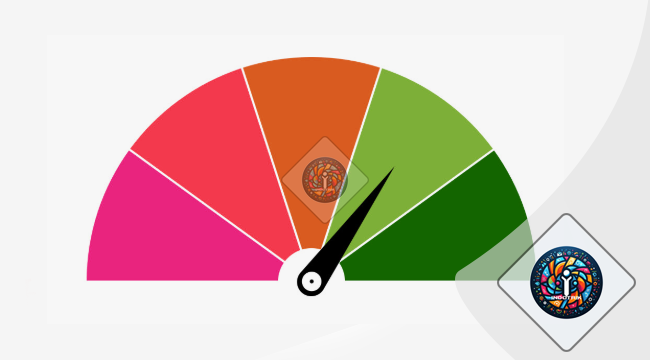

Here’s where your 770 credit score stands:

- FICO: Very Good (740-799)

- VantageScore: Excellent (750-850)

You’re officially in a position to qualify for the best financial products.

2. Above the National Average

In 2024, the average U.S. credit score is around 714. That means a 770 score places you well above the national average, making you part of an exclusive financial group.

What Can You Achieve with a 770 Credit Score?

1. Lower Interest Rates

A 770 score unlocks some of the lowest interest rates on loans and credit cards. Whether it’s a mortgage, car loan, or personal loan, your stellar score ensures lenders compete for your business.

2. Access to Premium Credit Cards

You can qualify for premium credit cards with high rewards, such as:

- Travel Cards: Earn miles for flights, hotel stays, and upgrades.

- Cashback Cards: Enjoy higher cashback rates on everyday purchases.

- Exclusive Perks: Priority boarding, concierge services, and more.

3. Better Insurance Rates

In some states, your credit score can impact your insurance premiums. A 770 score might help you score better rates on auto or homeowner’s insurance.

4. Easier Loan Approvals

From mortgages to business loans, a 770 score makes you a top contender for approval. Plus, you’ll likely secure more favorable terms.

How to Maintain or Improve Your 770 Credit Score

1. Keep Payment Perfection

Your payment history accounts for 35% of your score. To maintain a 770, paying every bill on time is non-negotiable. Use reminders or set up autopay to ensure you never miss a due date.

2. Monitor Credit Utilization

Even with a great score, keep your credit utilization low—ideally below 10%. For example, if your credit limit is $10,000, aim to use no more than $1,000 at any given time.

3. Avoid Unnecessary Hard Inquiries

While occasional credit applications are fine, too many hard inquiries in a short period can ding your score. Be selective about applying for new credit.

4. Protect Your Credit History

The length of your credit history matters. Avoid closing old accounts, even if you don’t use them regularly. The age of those accounts adds stability to your score.

5. Watch for Errors on Your Credit Report

Mistakes happen. Check your credit report annually for errors, like incorrect account balances or late payments that don’t belong to you. Dispute inaccuracies promptly to protect your score.

My Journey with a 770 Credit Score

Let me share a quick story. A few years ago, I hovered around a 720 credit score. It was good, but I wanted more. I focused on paying down balances, refrained from unnecessary credit applications, and made sure all my bills were on autopay.

When my score hit 770, I felt unstoppable. Suddenly, I qualified for premium credit cards that offered incredible rewards. My car loan interest rate dropped significantly, saving me thousands over the life of the loan. It wasn’t magic—it was just mindful credit management.

Why a 770 Credit Score Isn’t the End of the Road

1. There’s Still Room to Grow

While 770 is impressive, crossing into the 800+ “Excellent” range can unlock even more perks. Think slightly lower interest rates and even better credit card offers.

2. Financial Behavior Still Matters

Even with a high score, bad habits—like missed payments or over-utilizing credit—can quickly knock you down. Staying disciplined is key.

3. Life Happens

Unexpected events like medical emergencies or job loss can impact your score. That’s why building an emergency fund alongside maintaining a high score is crucial for financial resilience.

Final Thoughts: Is 770 the Golden Ticket?

A 770 credit score is undeniably impressive. It’s a testament to your financial discipline and opens doors to amazing opportunities, from lower interest rates to premium financial products.

However, it’s not just about the number—it’s about how you use it. Whether you’re looking to maintain your score or push into the 800s, consistency is key. Keep making smart financial decisions, and your credit score will continue to work in your favor.

So, congratulations on reaching 770! Now, let’s aim even higher while enjoying all the benefits this stellar score has to offer. You’ve got this.